Shepherd Money required a fresh approach to financial app design. This case study explores how I figure out an intuitive solution to harmonize AI capabilities and established financial management features.

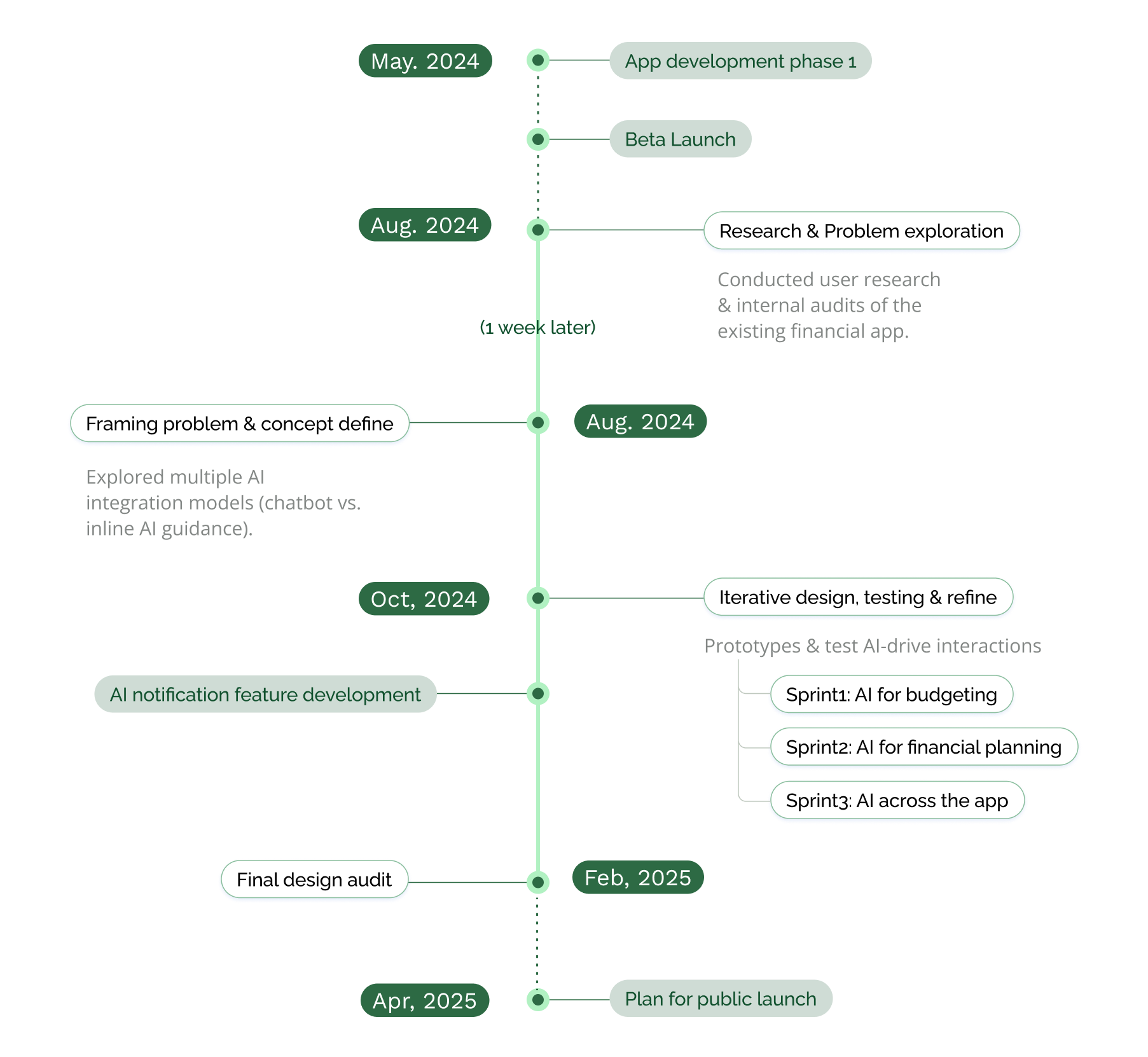

1 Year (May 2024 - May 2025)

3 Developers (Co-founders)

3 Product Managers

1 Graphic Designer

1 Product Design Intern

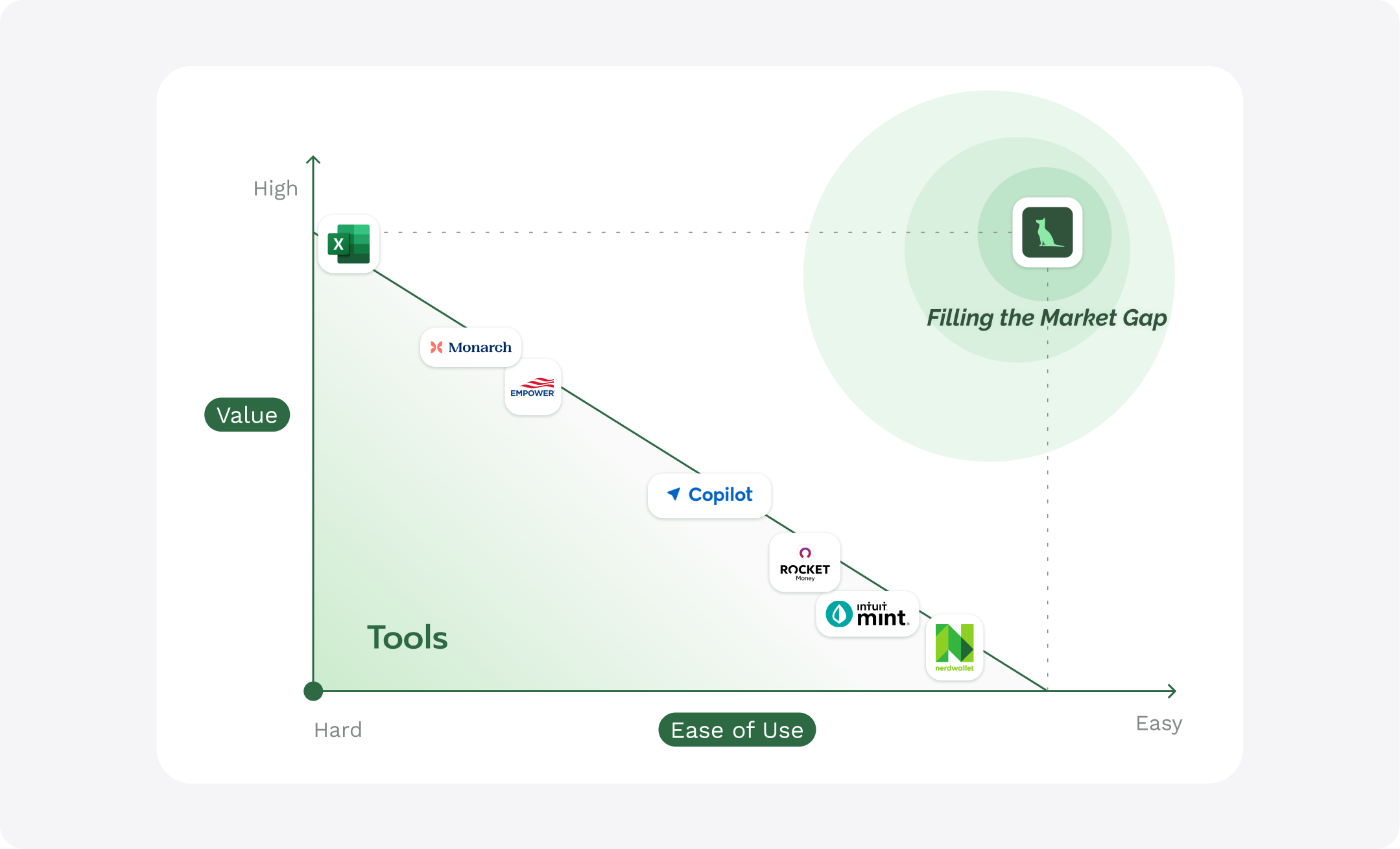

Shepherd Money was founded in 2022 by three engineers with a vision to bridge a market gap—creating a powerful yet user-friendly financial management app powered by AI.

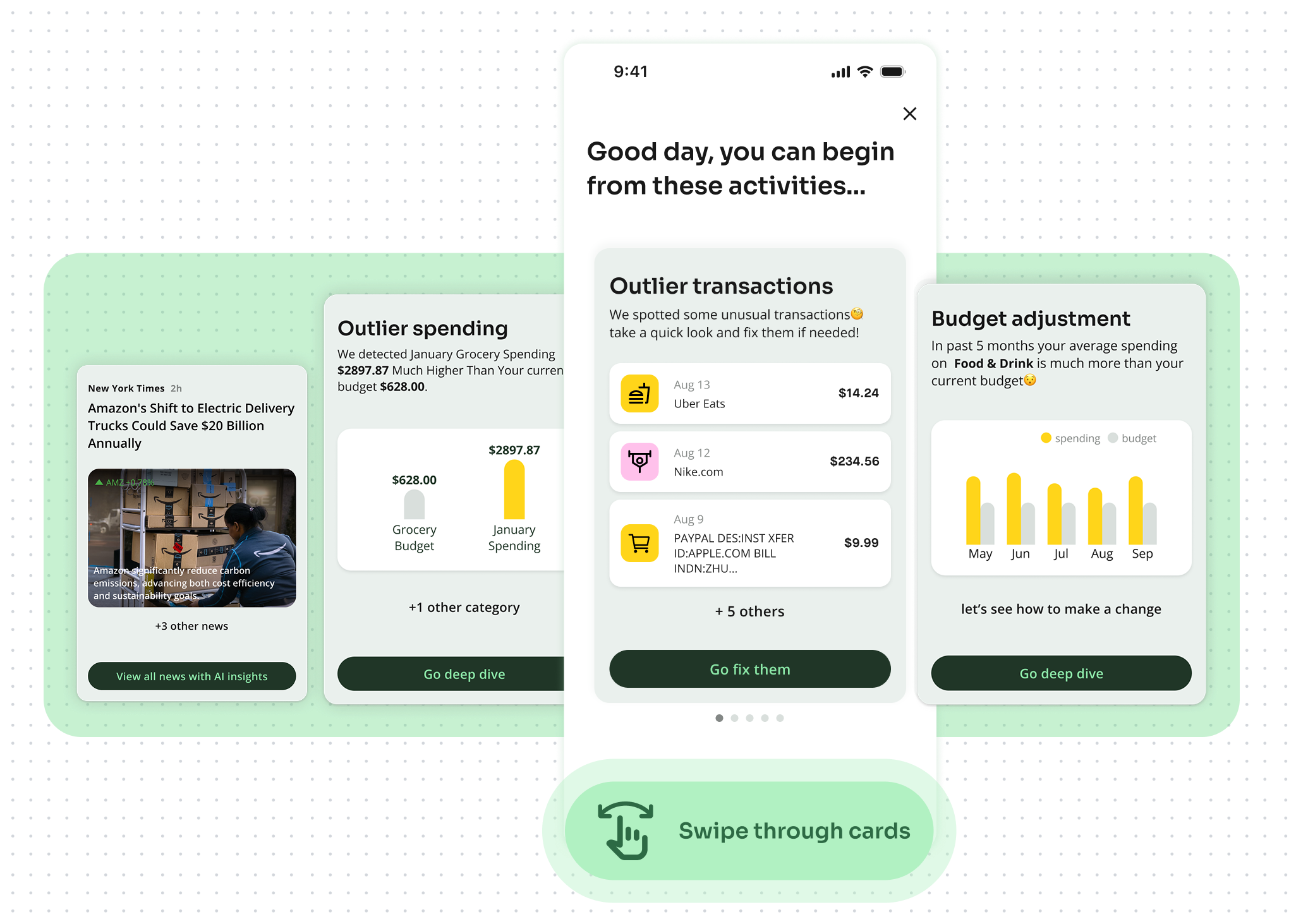

In 2024, I joined their design team, I was initially tasked with a UI revamp (View case study) and a redesign of the AI Copilot page. However, I quickly realized that improving isolated AI page or UI elements wouldn’t be enough—the entire user experience requires a more holistic optimization to make AI truly intuitive and valuable for users.

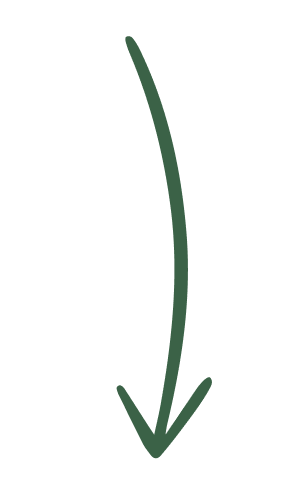

Proactive, personalized insights designed to be easily digestible — encouraging users to engage with AI from the start

A clear, layered experience — simple for beginners, detailed for power users, with smart alerts that highlight what matters most

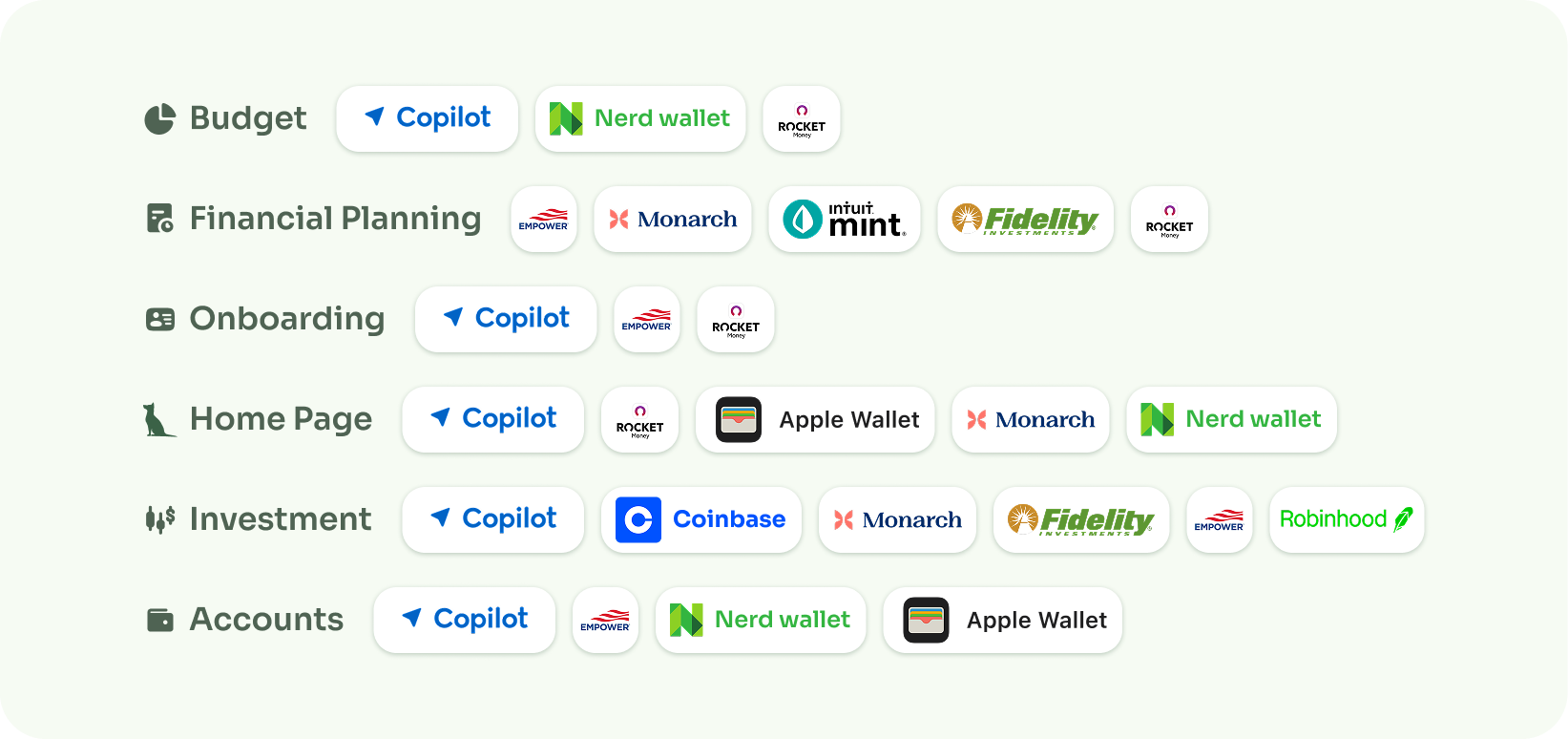

To ensure we covered essential features expected by users, I led the product & design team in benchmarking top-performing financial apps (relatively traditional ones).

We mapped out their key user flows in Figma and highlighted moments of strong user experience. View original materials.

⟡ Insights

1. Avoid jargon — keep language simple and easy to understand.

2. Don’t overwhelm users with complex calculations — focus on clear, useful takeaways.

3. Use more illustrations or visuals to make the experience more engaging.

4. We shall study from other AI-powered apps to learn what works and what doesn’t.

After analyzing relatively traditional financial apps, I found there are several recently launched AI-powered financial managing apps

⟡ Insights

1. Build features step by step — Adding all financial tools at once can affect quality and introduce unnecessary complexity.

2. Balance usability with visual attraction in early growth stage.

3. Maintain a clean, modern interface — Stick with a minimalist design, but don't be afraid to incorporate bold visual moments to create personality and stand out.

I analyzed tools that are wide used for financial planning in the market from Excel to NerdWallet and found them either hard to use or lack of useful features.

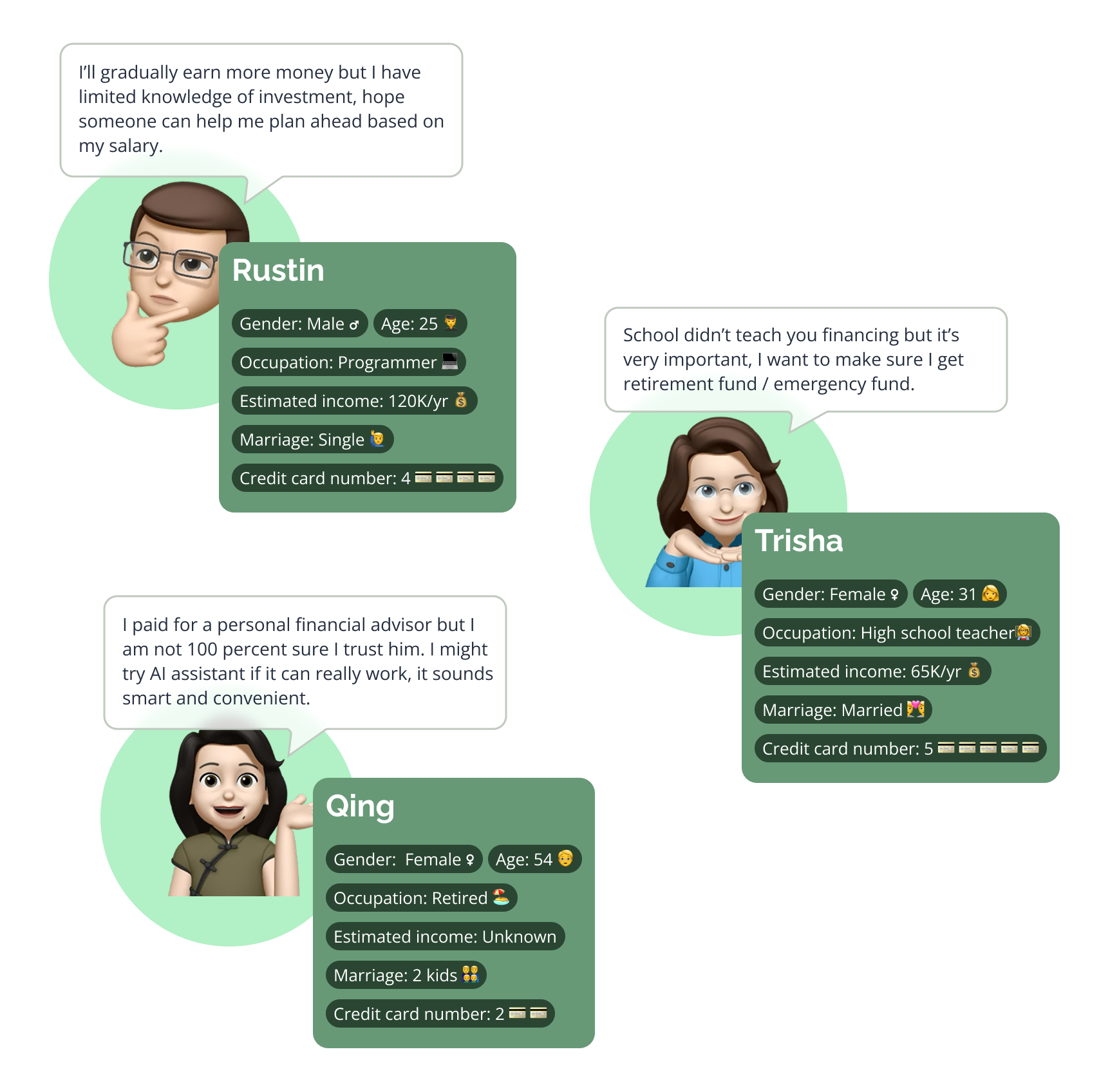

People with low financial knowledge & complicated financial situation have trouble managing their personal finance.

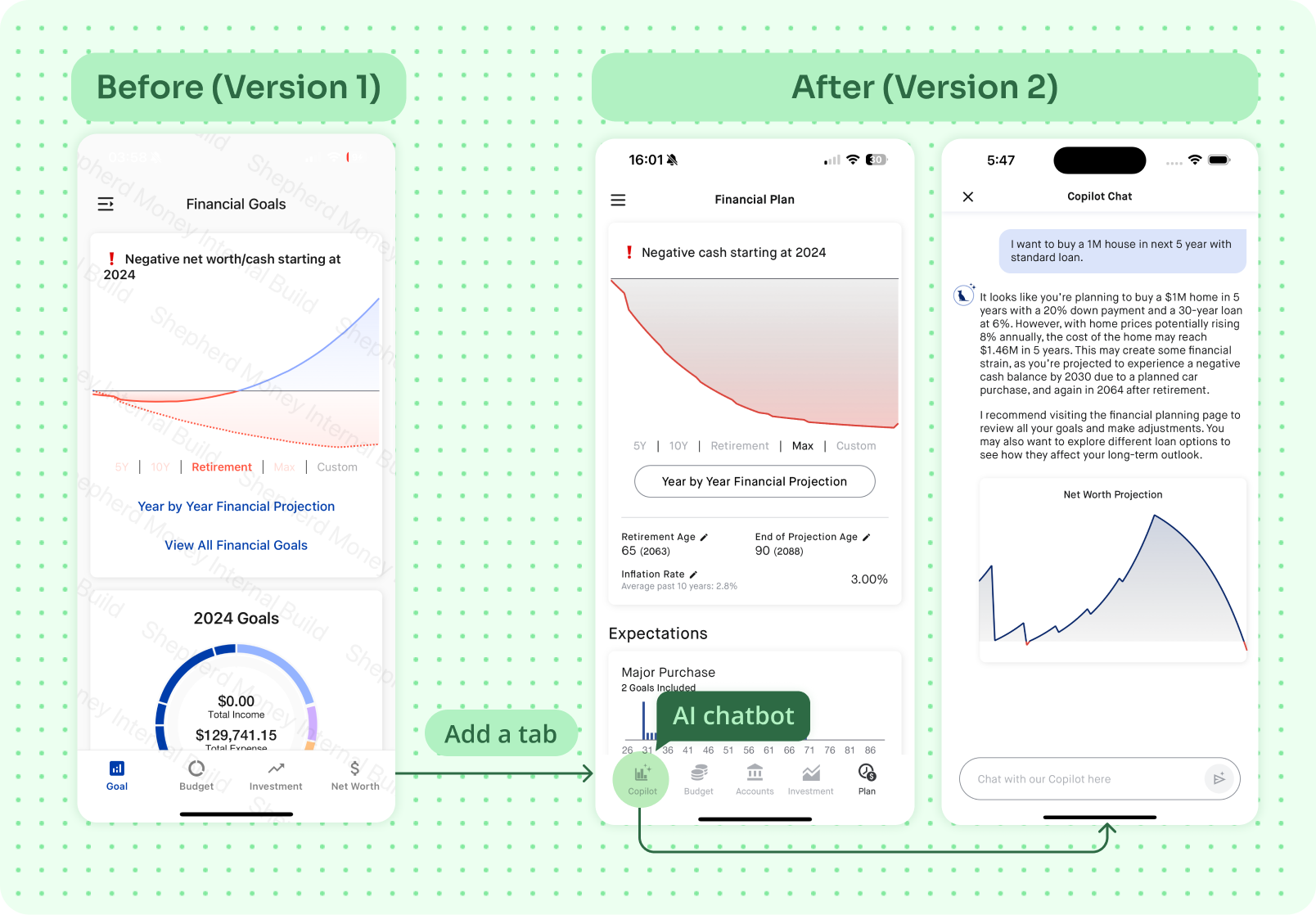

At first our PM thought we could add a chatbot to answer users' any question. So I designed a chatbot and remain other pages the same.

When I showcase the chat bot session to internal team members, they felt it really make sense to turn to chat for answers rather than searching for what they want in other pages... until we heard several users say:

I did 5 quick user testings with our AI implemented demo, soon realized that nearly all of them have no idea what to ask AI without guidance. But after I told them what AI can achieve, they think AI is super helpful for financial planning.

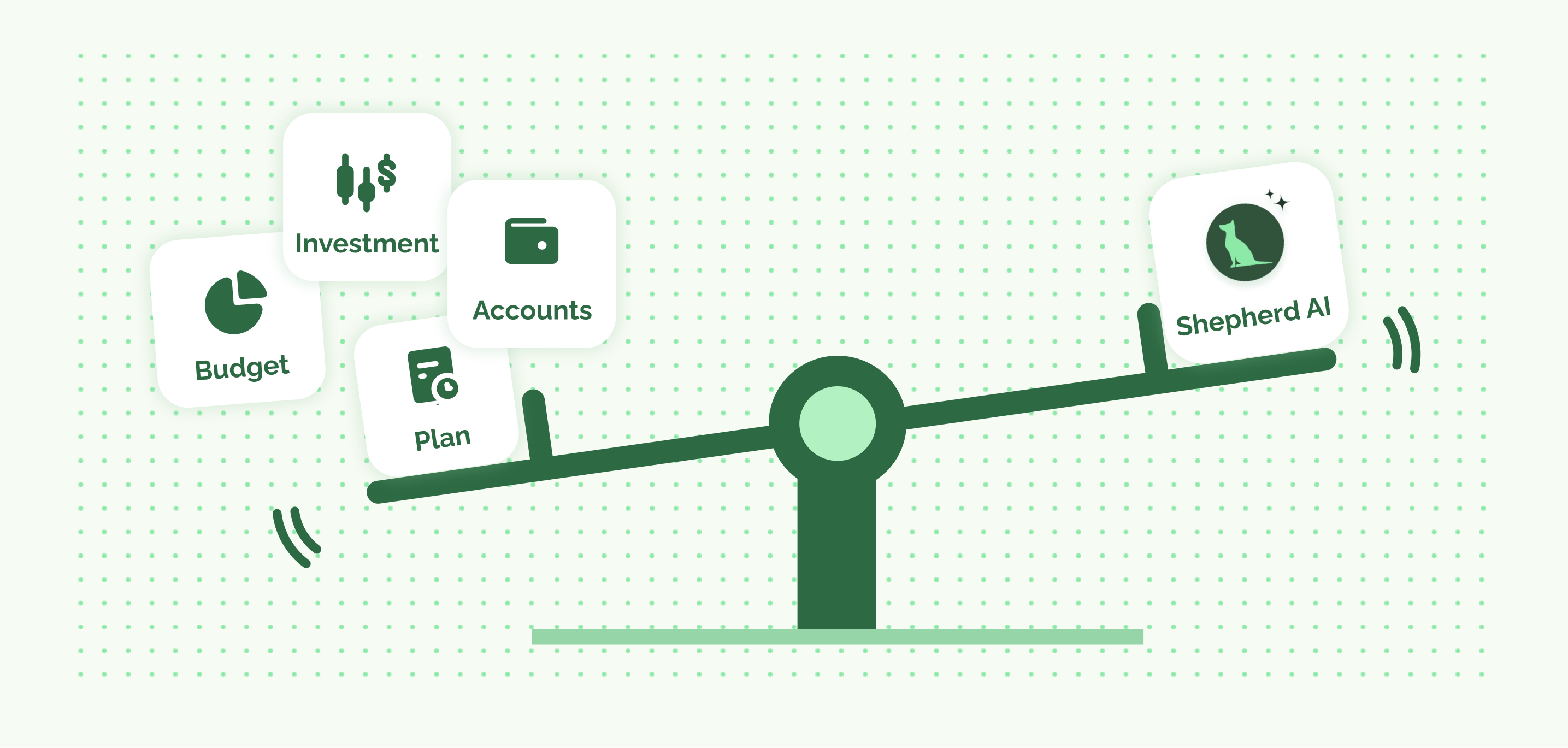

Our first approach leaned too heavily on AI, assuming it could handle everything while users passively consumed the rest. It quickly became clear that the real challenge was finding the right balance between AI guidance & essensial information.

AI Notification

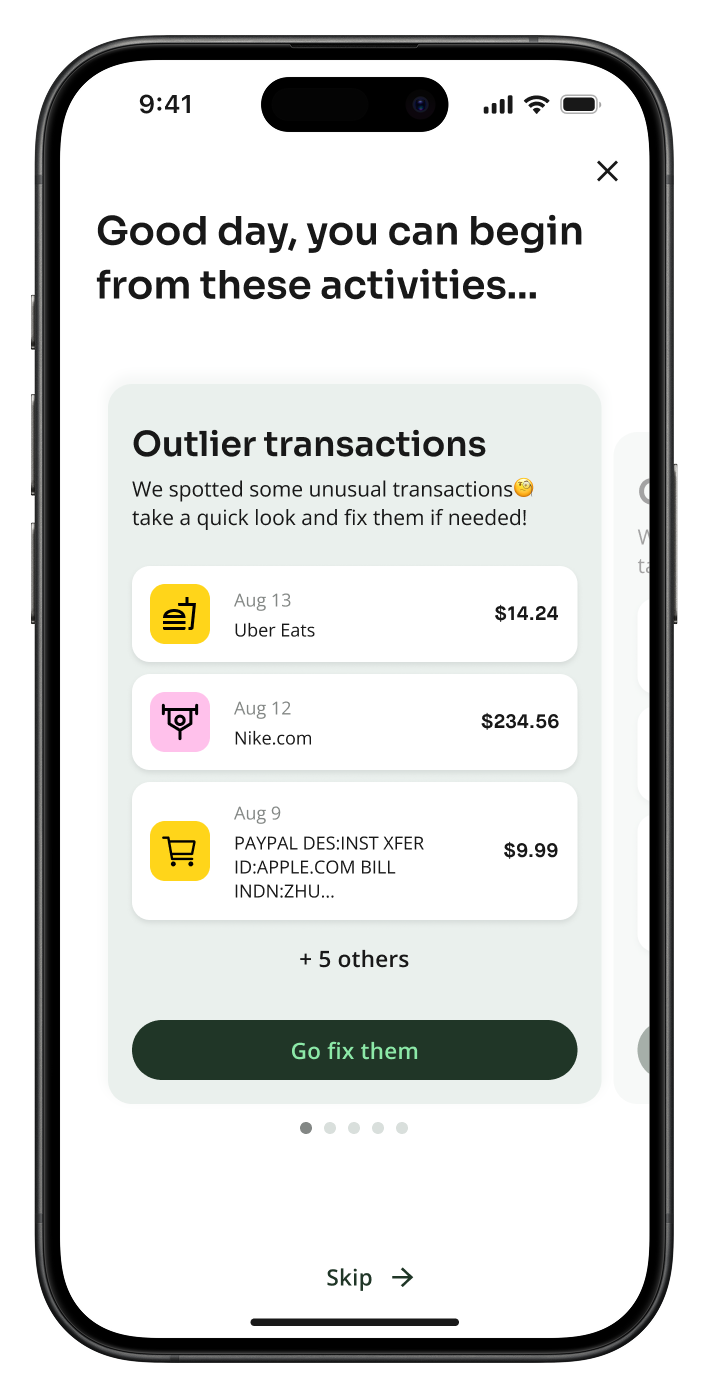

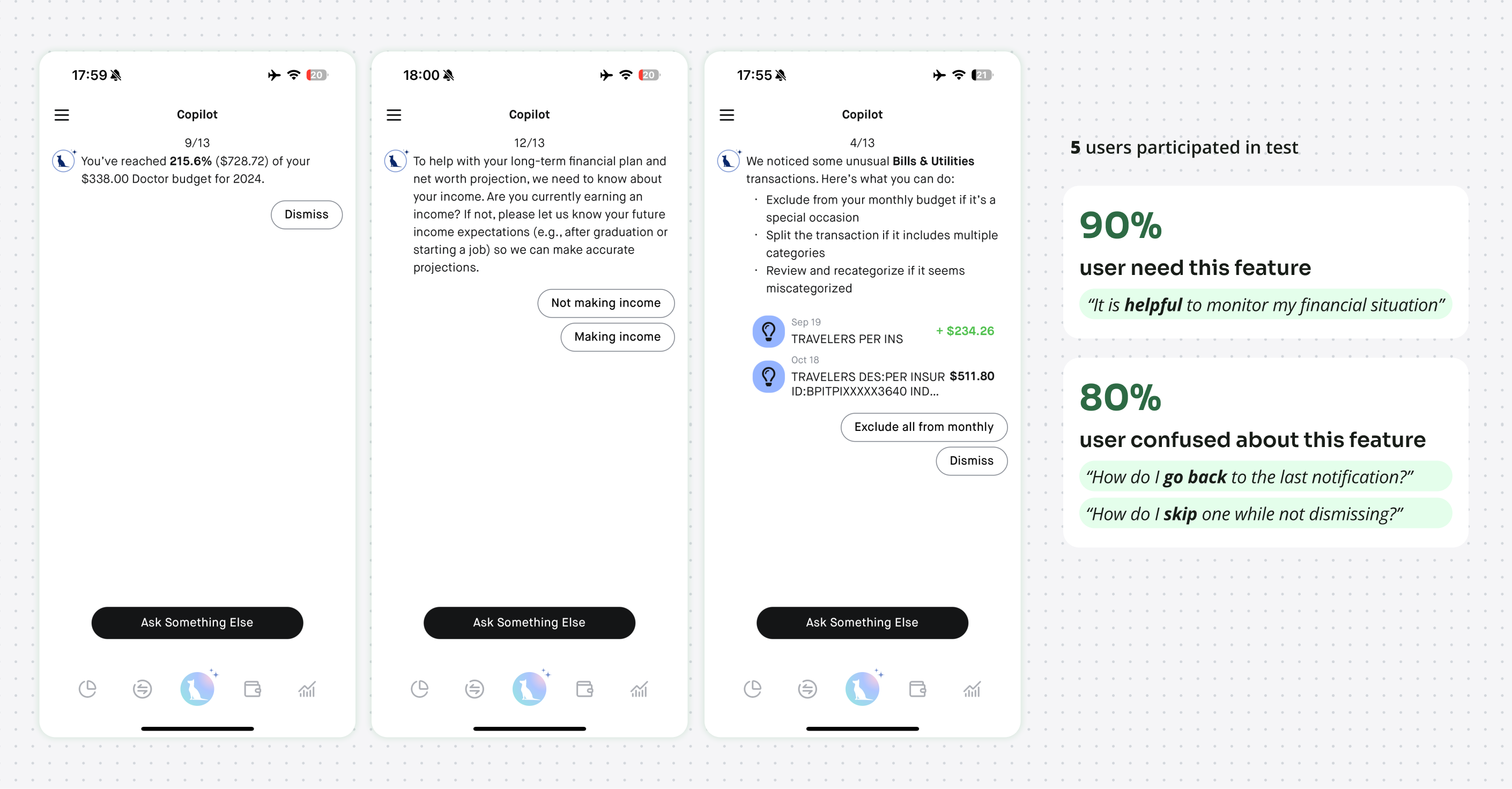

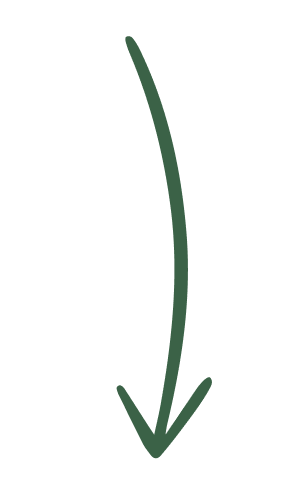

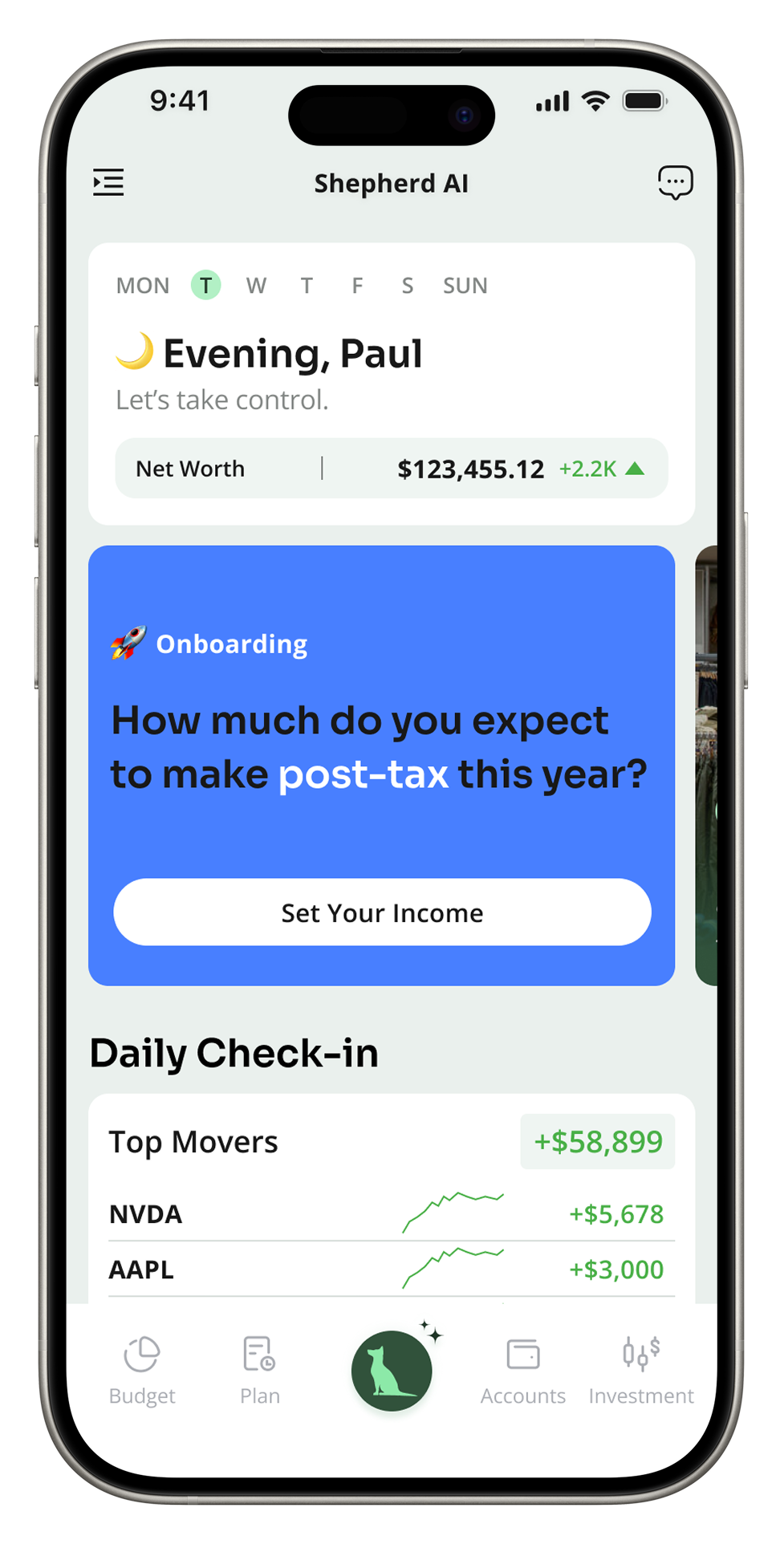

Proactive, personalized AI notifications deliver clear, digestible insights that encourage early user to engage and keep them informed without feeling overwhelmed.

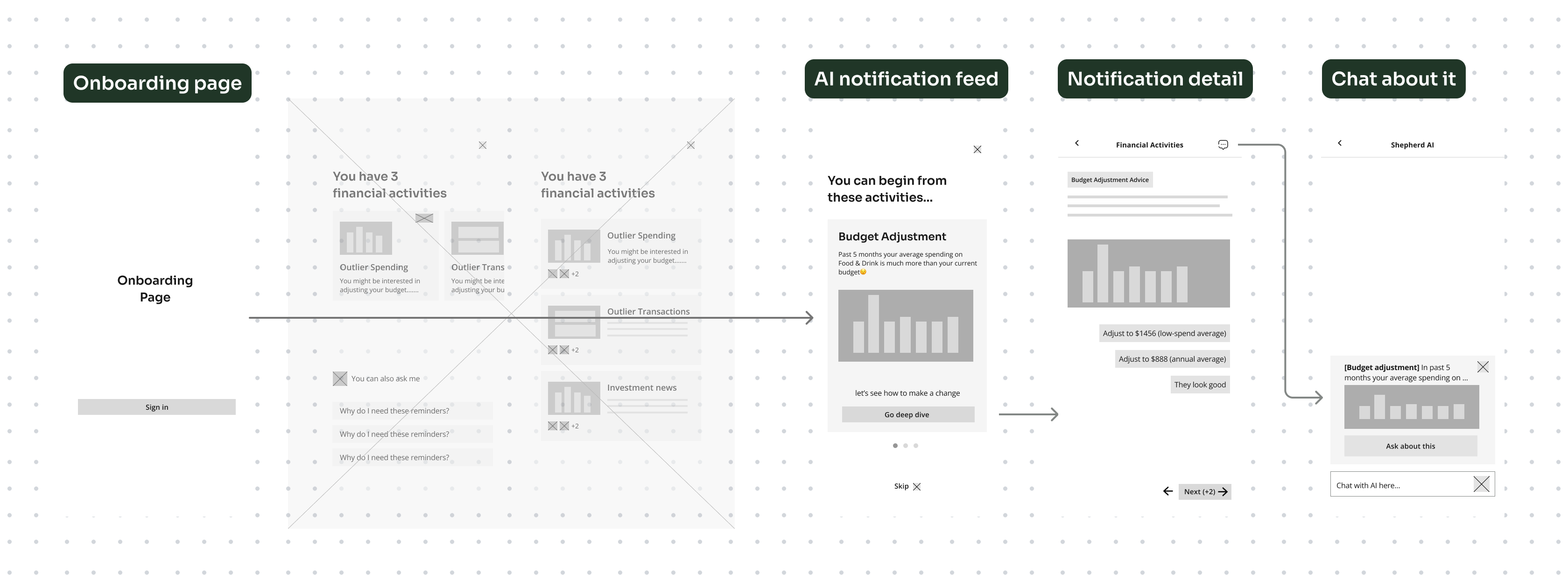

The AI notification was first launched on AI Copilot page, where users had to tap repeatedly to view each notification.

While the initial prototype was well-received — users appreciated having a tool to monitor irregular financial activities — many found the interaction confusing. They weren’t sure how to navigate between notifications or what actions to take next.

After several iterations with the PM, we decided to surface actionable AI notifications immediately after onboarding. This encourages users to engage with AI insights early on, streamlining the experience by helping them spot unusual financial activity without digging through complex charts and text.

Initially I have three home page proposals - dashboard, chatbox and notification feed.

Finally, We chose the notification list feed as our home page because it offers users the flexibility to explore financial updates at their own pace and dive deeper into what matters most. It highlights Shepherd Money's core value—smart, personalized financial management powered by AI.

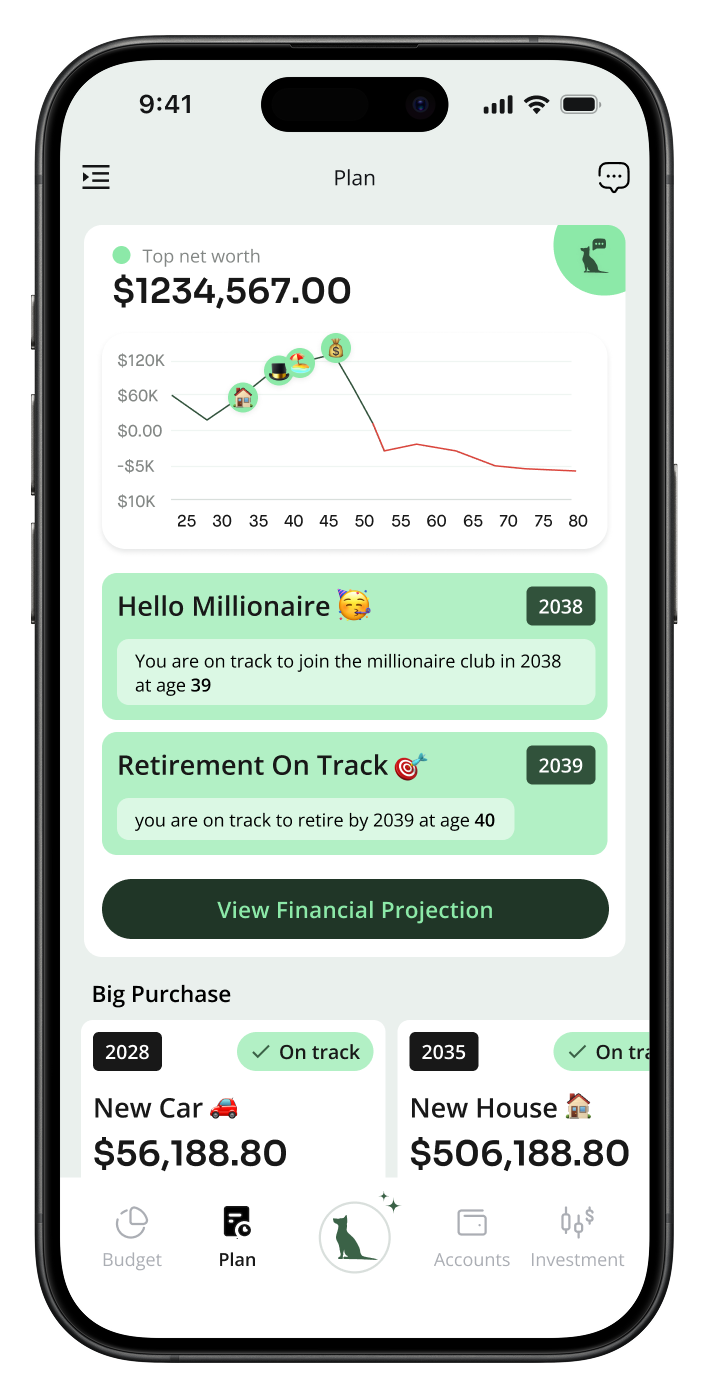

AI For Planning

To provide users with a clear, actionable overview of their financial future—powered by AI—while showcasing the most motivating and relevant data to support better decision-making and increase engagement.

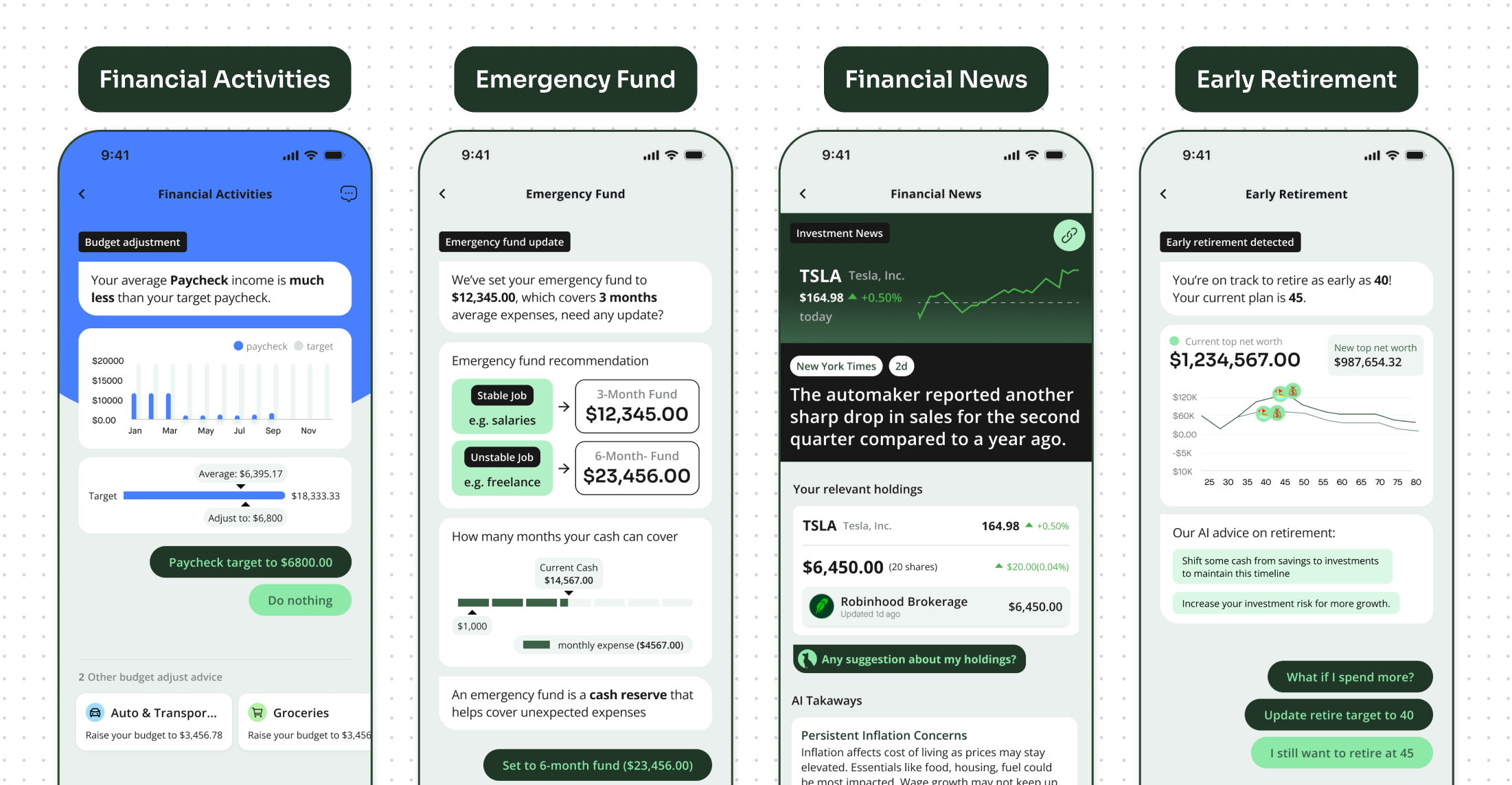

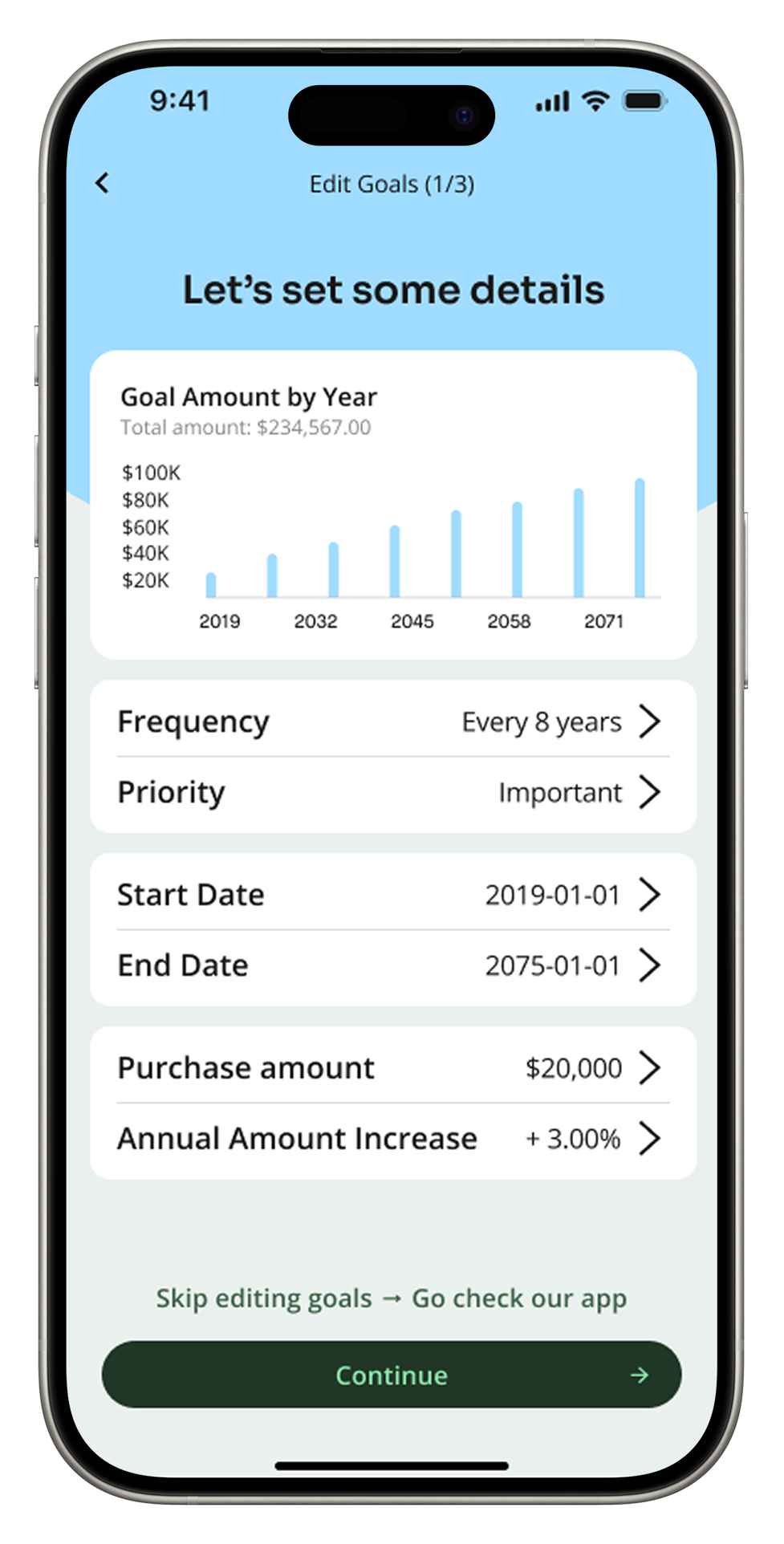

It was initially a core feature of our app, user could view their financial projection as a scale of life time. users can edit the dataset which affect this chart.

We observed that users consistently struggled to understand the financial data (which supposed to be interesting) because the information felt overly technical and disconnected from personal context.

I streamlined user actions and redesigned the financial planning experience from a static, spreadsheet-like layout into an intelligent, goal-oriented tool.

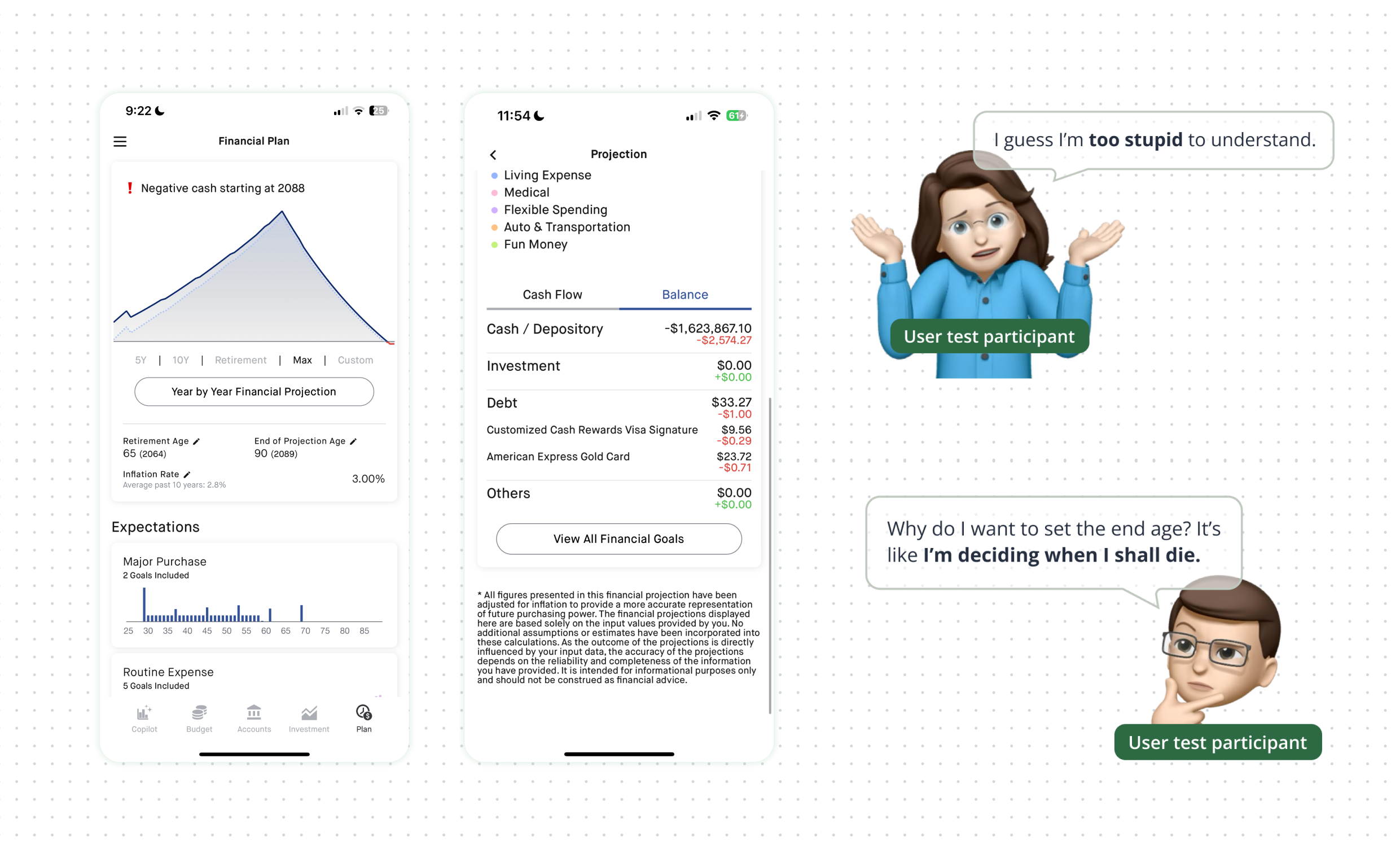

To avoid form fatigue while collecting key data (like income, DOB, and account info), we designed an onboarding flow with rich visuals, real-time feedback, and clear motivation to complete the process.

We give feedback right after they link first account - show net worth.

User can view the goal projection when they change any detail data.

After linear onboarding, user can still finish rest process any time through different pages.

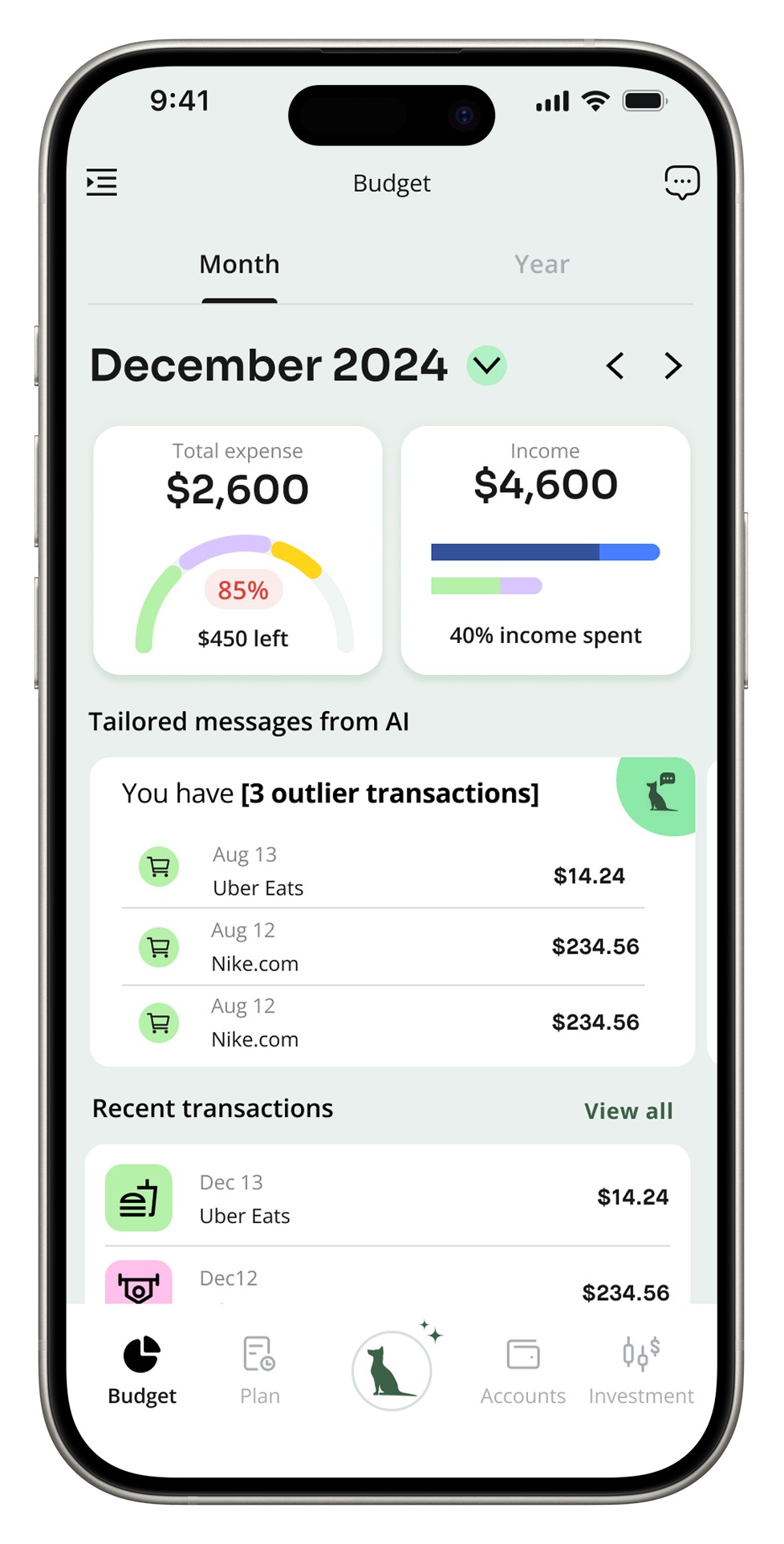

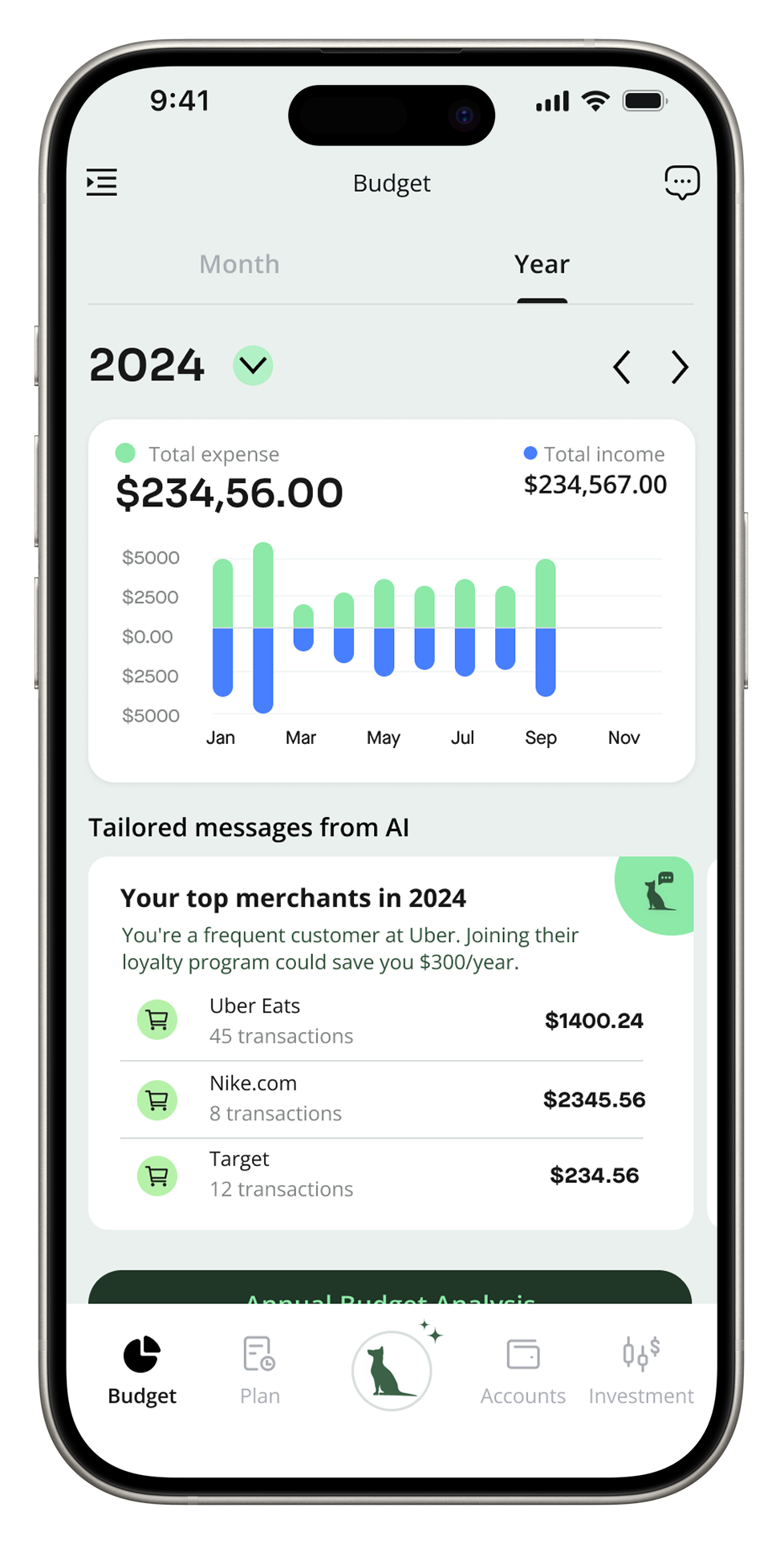

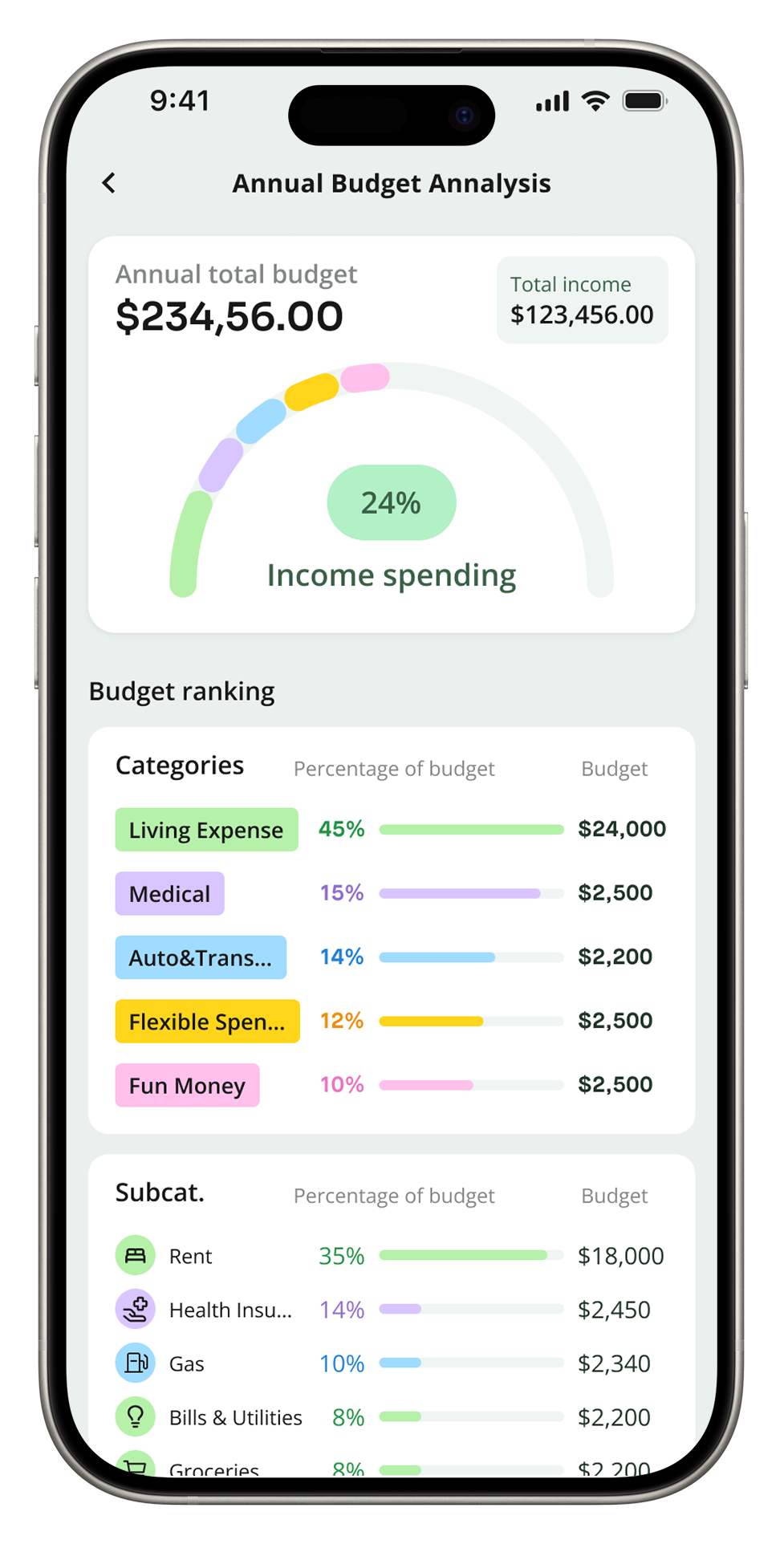

We designed the Budget feature to reflect how people actually manage money — not by setting strict limits, but by tracking real habits. Instead of forcing users to budget ahead, our system visualizes spending patterns, detects outliers, and adapts to each user’s natural flow.

Track spending in real time, see progress across categories, and spot unusual activity.

Reveal spending patterns of this year and help user to build awareness of financial habits.

View how much budget in each category, and how total budget compares to income.

This project challenged me to untangle complexity and in the end, I not only built a smarter tool but redefined what a financial app can feel like when AI becomes considerate and proactive.

Some takeaways: